Direct Deposit Setup for Students

IMPORTANT NOTICE

Students using Concur Expense still need to enter their banking in Concur and will still be paid through Expense Pay. These newer instructions are for currently enrolled GW students with payment requests submitted through Concur Invoice or manually processed by AP for non-payroll related expenses such as awards /prizes, stipends, etc. If receiving payments remitted through AP be sure that there is banking in this area within your profile otherwise a check will be issued.

Direct Deposit Setup for Students

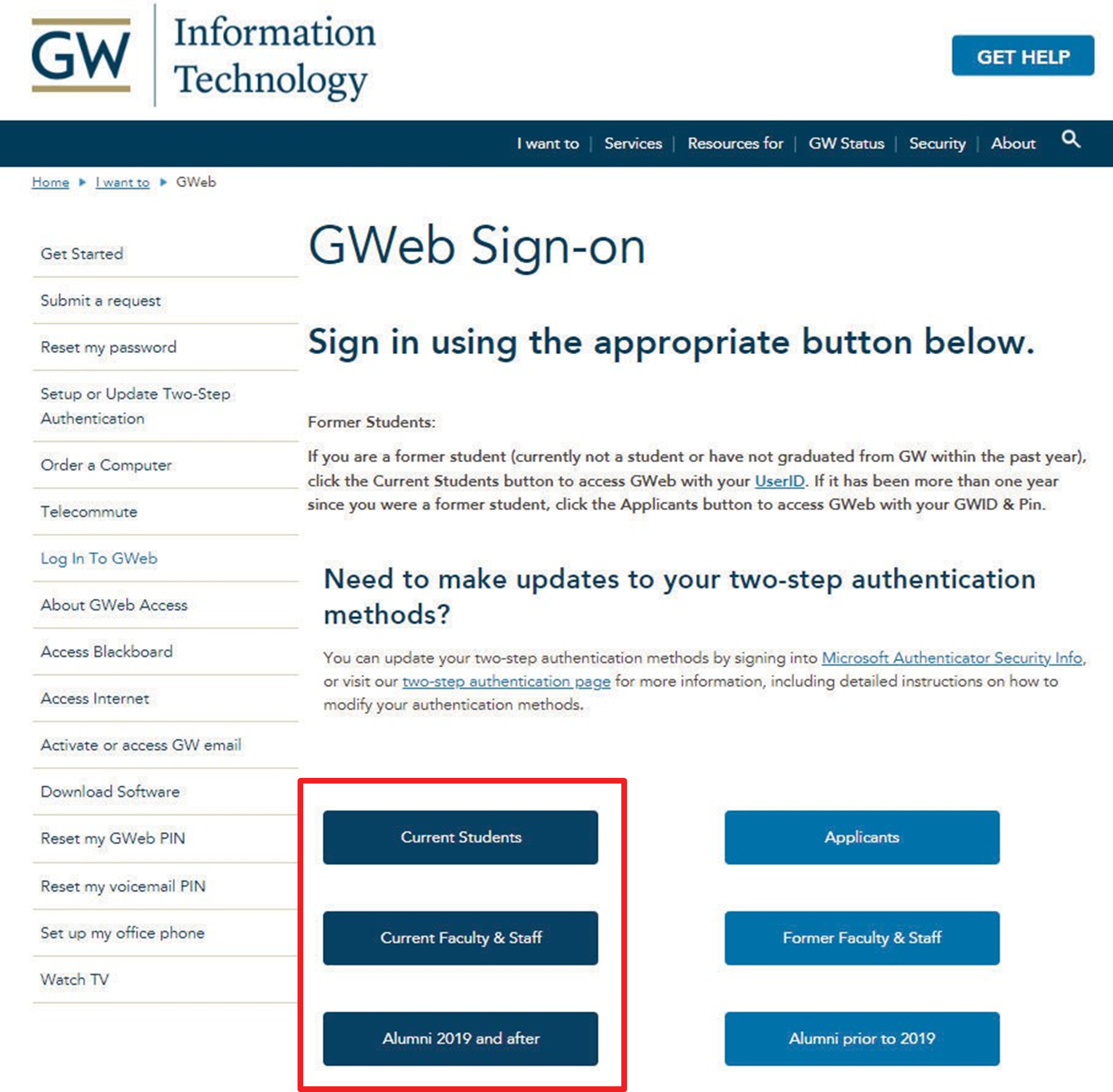

- Log in to the GWEB Information System

- Click Current Students, Faculty/Staff, or Alumni as of 2019.

3. Click View/Update Direct Deposit.

4. In the Proposed Pay Distribution, enter your bank information by clicking Add New.

5. Please see Tips at the bottom of this guide. Fill in bank information. Click Save New Deposit.

6. You will see the proposed Pay Distribution that you entered.

* If you are receiving payments through Payables, please be sure that there is banking in this area of your profile or a check will be issued.

Tips

- If adding multiple accounts, make sure one of them is designated as “Remaining”.

| Example of a Split $1,000 Direct Deposit (Net Amount) | ||

|---|---|---|

| Bank A | 10% | $100.00 (10% of net pay; remaining $900.00 |

| Bank B | 10% | $90.00 (10% of $900; remaining $810.00 |

| Bank C | Remaining | $810.00 (all after Bank B; remaining $0.00 |

- Direct Deposits are created up to a week in advance of payday.

- Do not use a routing number from a savings deposit slip. Please verify with your bank for the proper routing number for ACH purposes.

- Some checks have a special routing number in small print noted for ACH purposes. Please use this number for the Bank Routing Number.

- Enter every number of your account, even if they are zeros. Enter the numbers together (no dashes, no spaces).

- Routing numbers are always 9 digits long (no letters).

- If you are setting up a money market account, please verify with your bank if they consider this account to be savings or checking. Indicating the wrong type of account will result in your funds being rejected.

-

Where to get your banking information:

-

Call your bank

-

Personal check or mobile app

-

Personal Check

Mobile App